Qualified Charitable Organizations

Qualified Charitable Organizations

Cancer Support & Domestic Violence | Family Assistance & Food Banks | Healthcare | Housing Support & Senior Services | Social Services | Special Needs | Youth Development

Social Services

Arizona Justice Project

The mission of the Arizona Justice Project is to seek justice for the innocent, the wrongfully imprisoned and those who have suffered manifest injustice under Arizona’s criminal justice system.

The Arizona Justice Project is the only nonprofit organization in Arizona dedicated to helping those who have been wrongfully convicted regain their freedom. Over the past 25 years, the AJP has helped free 43 individuals! Many of these individuals spent decades in prison, away from their families and communities. Along with providing free legal services, AJP also assists clients with re-entry, providing support for housing, work, education and access to healthcare.

Social Services | Tax Code 20725

Assistance League of Phoenix

Helping children in need, strengthening families. Assistance League of Phoenix helps families experiencing poverty by providing clothing assistance for children in grades K-8.

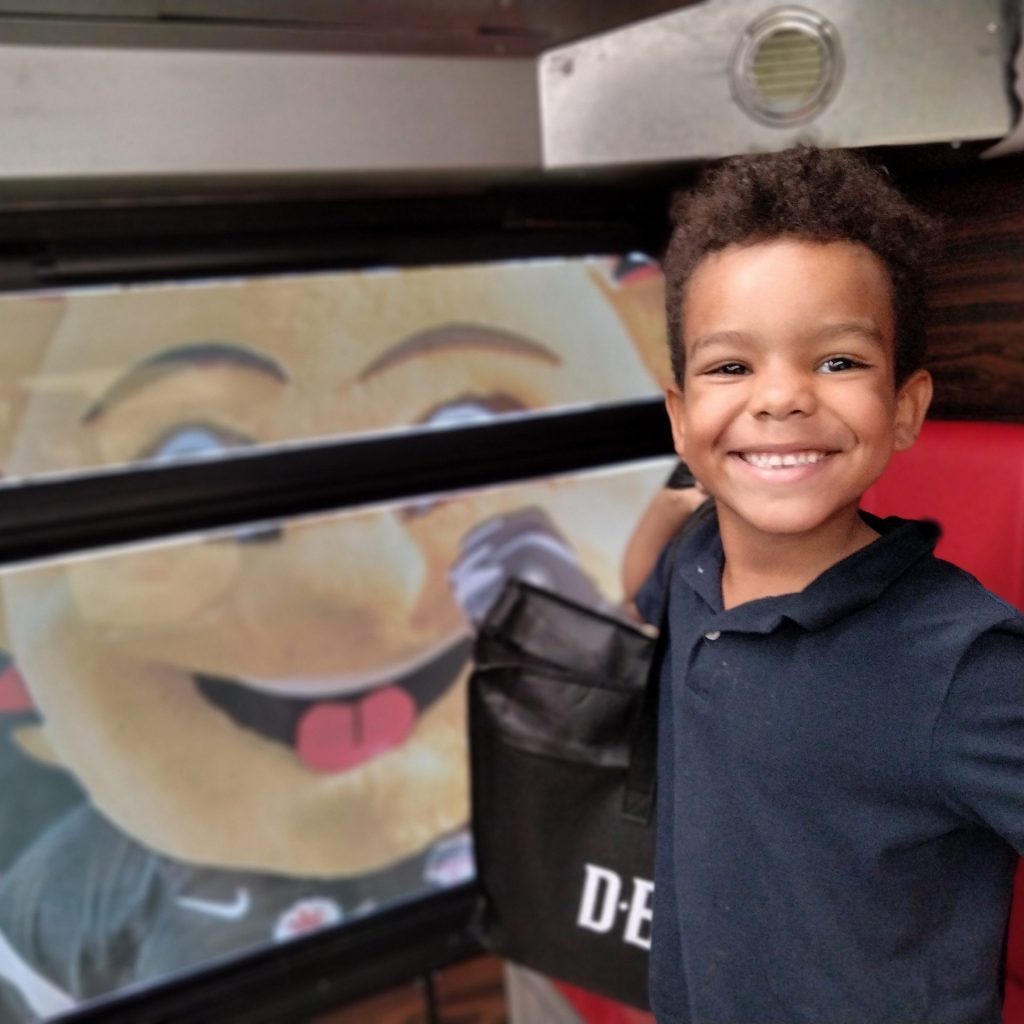

Assistance League of Phoenix has been serving children and families in our community for over 63 years. Your tax credit donation will provide children in our community who are food/clothing insecure with a new wardrobe package (clothing, shoes, hygiene items and books). To bring the program directly to children, our three Delivering Dreams Buses travel across the Valley, serving over 13,000 children, grades K-8, living in poverty at 130 Title I schools throughout the school year. We also serve children living in foster care, experiencing homelessness, and refugees. Last year, over 47,000 children were served through our programs.

Social Services | Tax Code 20533

Brain Injury Alliance of Arizona

The Brain Injury Alliance of Arizona creates better futures for all Arizonans through brain injury prevention, education, advocacy and support.

Brain Injury Alliance of Arizona’s vision is to create a state where all individuals impacted by brain injury thrive in their community. We work to improve the quality of life for everyone affected by brain injury by providing advocacy, education, information, support and resources, while promoting brain injury prevention.

Social Services | Tax Code 22360

Chicanos Por La Causa

Chicanos Por La Causa’s mission is to drive economic and political empowerment in our community.

Since 1969, Chicanos Por La Causa has empowered individuals and families, enabling them to achieve the American Dream. Each year, we impact almost one million lives through our Health & Human Services, Housing, Education, Economic Development, and Advocacy initiatives. While our services are offered to all people, regardless of ethnic background, we have a special competence in serving the Latino community and have become the most recognized and trusted provider of services to Latinos in Arizona.

Social Services | Tax Code 20056

Dress for Success Phoenix

Our mission is to empower women to achieve economic independence by providing a network of support, professional attire and development tools to help them thrive in work and in life.

Dress for Success Phoenix’s life-changing programs include free services that range from job skills preparedness, coaching, workshops, cohort-based learning, styling and professional attire. Additionally, Dress for Success Phoenix provides access to certificate and degree programs through Maricopa Community Colleges and Arizona State University via the organization’s EducateHER program. Dress for Success Phoenix has designed these offerings to reach individuals when and where they are along their personal journey.

Social Services | Tax Code 20168

Fresh Start Women’s Foundation

Fresh Start’s mission is to provide access and resources that help women achieve self-sufficiency and use their strength to thrive.

Fresh Start works toward a future of unlimited opportunities for all women. Our organization’s strategic approach — tailored to help women achieve economic self-sufficiency — centers on five key areas of service: Family Stability, Health and Well-Being, Financial Management, Education and Training, and Careers. Together, they form the Impact Program, a comprehensive pathway to personal empowerment. Through access to our in-person and virtual workshops, workforce training, family law support, and other resources, thousands of women aged 18 and older have transformed their lives and, in turn, the lives of their children, families and the broader community.

Social Services | Tax Code 20525

HOPE for the Homeless, Inc.

HOPE for the Homeless’ mission is to help get folks off the streets and into treatment programs for their mental illness and substance abuse issues.

HOPE for the Homeless produces 2,500+ HOPE bags each month. These bags contain the daily essentials for life on the streets: toiletries, a first-aid kit, sunscreen, socks, an emergency blanket, food and a resource card. We, along with multiple other outreach partners, use these bags as an icebreaker to initiate the conversation about getting them help. Our goal is to get them on a path to a life filled with love and purpose!

Social Services | Tax Code 22067

Keys to Change (formerly Human Services Campus)

The Human Services Campus, Inc. is a unique model in the U.S. for serving single adults experiencing homelessness. Our mission is “Using the Power of Collaboration to End Homelessness.”

Tax credit gifts help provide services 365 days a year to the most vulnerable in our community. HSC serves over 1,700 people daily with street outreach, client intake and assessments, reunification with family/friends, postal services, shelter, navigation to housing, Social Security assistance, bridge housing, coordination with behavioral health clinics, connections to dozens of life-changing services and more. With hundreds of people living on the streets surrounding the Campus and over 900 sheltered on the Campus every night, the goal is to reduce the time people experience homelessness and ultimately acquire a place to call home.

Social Services | Tax Code 20970

Jewish Family & Children’s Service

Jewish Family & Children’s Service is dedicated to strengthening the community by providing behavioral health, healthcare and social services to children, teens and adults of all ages, faiths and backgrounds.

Our wide range of social services to residents of Maricopa County includes child welfare programs, support for families in transition, programs for foster care youth, domestic violence services, and counseling and resources for older adults.

Social Services | Tax Code 20255

Mary Gloria Foundation (formerly Pan Da Vida Foundation)

Pan de Vida Foundation’s mission is to meet children, senior citizens and family basic needs while promoting self-sufficiency in Queen Creek and San Tan Valley areas.

The nonprofit Pan de Vida Foundation has been serving its community for the past 20 years. As the communities of Queen Creek and San Tan Valley grow, so do the support programs of PDVF. It offers community food resources, a backpack program, Christmas giving, community revitalization, free health and wellness clinics, mammography screening for breast cancer awareness, programs for creating a safe, fun and engaging environment for the whole family, resources and information for disability awareness, and a ladies’ group to network and take away information and knowledge for a healthier lifestyle for themselves and their families.

Social Services | Tax Code 20379

NourishPHX

NourishPHX is the trusted community hub serving vulnerable individuals and families by offering resources to satisfy immediate needs and provide pathways to self-sufficiency.

Your support helps low-income community members nourish their minds, bodies and souls with food, clothing, hygiene, SNAP outreach, a Job & Resource Center and a variety of classes/workshops from financial education to yoga. With your contributions, more than 17,000 people get the assistance they need each year.

Social Services | Tax Code 20385

Phoenix Indian Center

Phoenix Indian Center serves the American Indian community with culturally relevant youth services, language and cultural revitalization programs, education and workforce development.

Tax credit contributions support valuable programs to help over 9,000 community members receive support and education in parenting, substance misuse and suicide prevention, workforce development and career guidance, culture and language revitalization programming, youth leadership skill-building and more. Funds also aid our work to provide basic needs to families that lack sufficient resources due to long-term impacts stemming from the pandemic and other life circumstances. We are proud to be the first and oldest urban American Indian center in the U.S. For 76 years, we have reached thousands, and with your support, we can reach many more youth and families.

Social Services | Tax Code 20394

The Salvation Army

The Salvation Army has been helping Arizonans in need overcome poverty, addiction and economic hardships through a range of social services for 130 years.

Your generous tax credit contributions help The Salvation Army provide food for the hungry, emergency shelter and clothing for the homeless, rent and utilities assistance, disaster and heat relief, holiday joy, senior activity and outreach, adult rehabilitation, skills training, opportunities for underprivileged children, and emotional and spiritual support — “Doing the Most Good” for over 280,000 people annually through more than 50 centers of operation throughout Arizona. The Salvation Army ranks #4 on Forbes’ latest list of America’s Top 100 Charities.

Social Services | Tax Code 20671

U.S.VETS – Phoenix

U.S.VETS – Phoenix is on a mission to end veteran homelessness. We’ve been caring for our community’s homeless and at-risk veterans through our housing programs and professional services for 20 years.

Your tax credit contributions will help U.S.VETS – Phoenix in our mission to end veteran homelessness in Maricopa County and throughout Arizona. Our programs include transitional, emergency and permanent housing; individual, group and family counseling; mental health services; substance abuse treatment; individualized case management plans and legal services; supportive services for veteran families; job search assistance and supportive employment needs; and outreach services to provide clothing, food and emergency shelter. Your funds will also help support our newly opened MD Hawkins Veteran’s Center.

Social Services | Tax Code 20756

WHEAT

Since 1979, the WHEAT organization has worked to end hunger and poverty at the root. WHEAT’s mission is to educate, advocate, engage and empower individuals in the fight against hunger and poverty.

Our major programs include the Clothes Silo, a clothing boutique empowering economically disadvantaged women through the provision of free workwear and offering on-the-job training, as well as the Fair Trade Store, a retail shop partnering with artisans and small-scale farmers around the globe to help break the cycle of poverty through fair and ethical trade.

Social Services | Tax Code 20391